- About Us

- Products

- SAP Products

- SAP S/4HANA

- SAP S/4HANA CLOUD

- CRM and Customer Experience

- SAP S/4HANA Fashion and Vertical Business

- Human Capital Managament

- SAP IFRS

- IFRS 16 + Real Estate

- Development and Integration

- Digital Supply Chain

- Easy Collection Tracking Through

- Closing Cockpit

- SAP S4 POS Data Transfer and Audit

- SAP logistics

- Prodea Products

- BPM Solutions

- Services

- About Us

- Products

- SAP Products

- SAP S/4HANA

- SAP S/4HANA CLOUD

- CRM and Customer Experience

- SAP S/4HANA Fashion and Vertical Business

- Human Capital Managament

- SAP IFRS

- IFRS 16 + Real Estate

- Development and Integration

- Digital Supply Chain

- Easy Collection Tracking Through

- Closing Cockpit

- SAP S4 POS Data Transfer and Audit

- SAP logistics

- Prodea Products

- BPM Solutions

- SAP Products

- Services

- Sectors

- References

- Blog

- Career

- Contact Us

SAP IFRS

- Prodea Consulting

- SAP IFRS

High Standard in Financial Statements: SAP IRFS

What is SAP IFRS?

Financial reporting is very important for every business and should be done with high accuracy and in accordance with established standards/regulations. IFRS (International Financial Reporting Standards) are a set of accounting standards developed by the International Accounting Standards Board (IASB), an independent, not-for-profit organization.

It was developed to provide a framework that can be used globally by companies to prepare their financial statements. SAP offers a solution that can follow multiple accounting systems in parallel using the financial ledger structure. In addition to VUK and IFRS, other accounting recording systems (such as CMB, GAAP, customized corporate group accounting standards) can be followed at the same time. SAP IFRS provides general guidance for the preparation of financial statements for all industries, rather than setting separate reporting rules for different industries.

As a legal requirement, the Communiqué on Financial Reporting Standard for Large and Medium-Sized Enterprises and its annex "Financial Reporting Standard for Large and Medium-Sized Enterprises" were published in the Repeated Official Gazette dated July 29, 2017 with the number 30138. The Financial Reporting Standard for Large and Medium-Sized Enterprises (BOBİ FRS) is a financial reporting framework to be applied by enterprises that are subject to independent audit and do not apply Turkish Financial Reporting Standards (TFRS). The objective of the SOBI FRS is to provide financial statements that are fair, consistent with the need for financial information and comparable. 4,700 companies will apply the SOBI FRS as of 1/1/2018.

General criteria according to the aforementioned Council of Ministers Decree No. 2016/8549;

a) Total assets of 40 million or more Turkish Liras.

b) Annual net sales revenue of 80 million or more Turkish Liras.

c) Number of employees is determined as 200 and above.

In 2018, those exceeding the criteria determined by the Council of Ministers No. 2016/8549 (by evaluating 2016 and 2017 Data) are subject to Independent Audit. However, with the publication of the BOBİ Financial Reporting Standard, all companies reporting within the scope of the MSUGT (General Communiqué on Accounting System Implementation) must make their Financial Reports on 01.01.2018 and later and the Audit of these financial reports according to BOBİ FRS. (http://www.resmigazete.gov.tr/eskiler/2017/07/20170729M1-1.htm)

In addition to legal requirements, the most important factor in the need for IFRS is that different countries have different recording rules and different financial reporting regulations. The different formats used make it difficult to operate the centralized rules required by the parent company and, of course, reporting in IFRS standards is necessary for more accurate results from a financial point of view. IFRSs, from an international point of view, bring the accounting procedures of all branches of a company into a standardized, comprehensible, worldwide set of recording rules and reporting formats.

Why SAP IFRS?

Flexibility

Although SAP IFRS basically applies one standard, it is very flexible due to its structure. It is possible for different companies to adapt their systems according to their own situations and make a valuation with different values. Using this flexible approach, companies can create financial statements that can be read by anyone.

Low Cost Impact

When IFRS reports are not prepared on the system, they are usually prepared by the company's financial advisors and this is an additional and ongoing cost for the company.

Reportable and comparable

It provides the convenience of receiving and comparative monitoring of reports, taking into account the time effect. Investors can access the company's actual financial statements very quickly and guide their decisions with this data.

Prodea

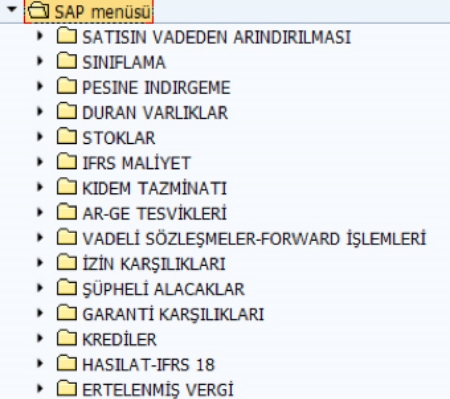

IFR cockpit

It is a workflow solution created to manage in-period and period-end IFRS transactions with a certain discipline. Each step is completed in order and necessary corrections and classifications are provided. By integrating with the Period Closing Cockpit, IFRS transactions can be carried out in parallel with the period closing procedures. By reporting based on TPL and IFRS on a single system, system integrity is maintained and possible inconsistencies are eliminated.

The menu tree is organized according to the steps to be applied specific to the business. In this way, IFRS bookkeeping is procedurized.

Blog

E-WayBill System Less Risk More Efficient Time

Prodea provides integration between the special integrator and SAP for the commissioning of e-waybill processes. In this way, risks for companies are...

Read More

E-WayBill System Less Risk More Efficient Time

Prodea provides integration between the special integrator and SAP for the commissioning of e-waybill processes. In this way, risks for companies are...

Demand Forecasting & Prodea Solution

Nowadays, it is one of the most important issues for the inventory planning teams of companies to minimize inventory costs and prevent overselling....

SAP S/4 HANA ERP SOLUTION

When enterprises reach a certain size, they need Enterprise Resource Planning (ERP) solutions that enable integrated management of an organisation's...

“Inspired by the Power of Change”

As Prodea, we know that the needs of the business world are constantly changing and we serve companies that believe that change is an opportunity. We develop solutions suitable for the needs of our customers and calibrate them to accepted standards. We offer end-to-end SAP solutions with our expert consultants in all SAP modules for the needs of our customers.

- SAP Products